Question of the Day: What's the average interest rate on a car loan for someone with bad credit?

If sticker prices shock you, just wait until you see the interest rates...

Answer:

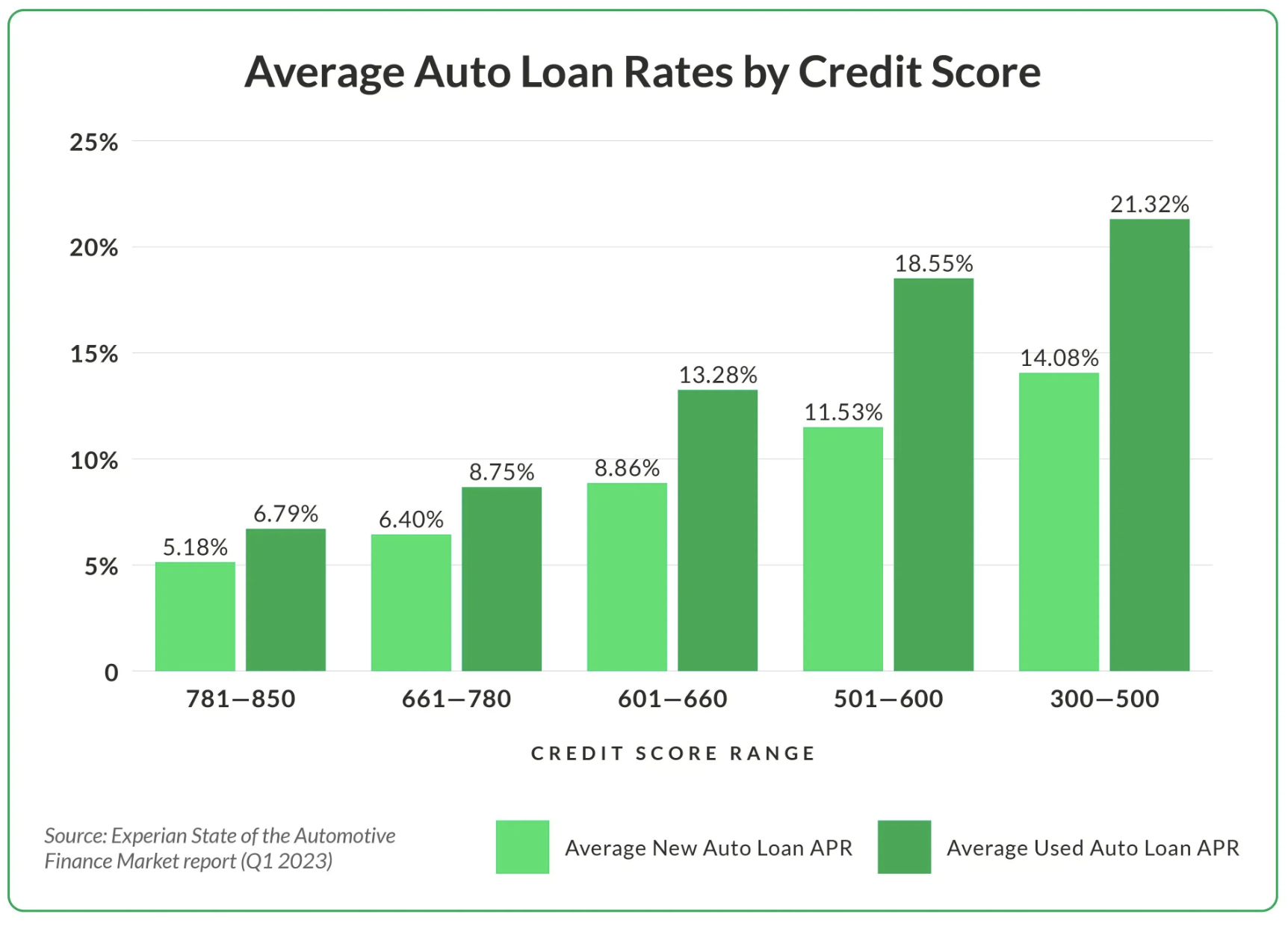

Used cars - 18.55% [Subprime: 501 - 600 credit score]

New cars - 11.53% [Subprime: 501 - 600 credit score]

Question:

- Give one example of an action that can cause a borrower to have “bad credit?"

- How does the interest rate affect the monthly payment on a car loan? Explain.

- Assume a borrower with bad credit took out a $20,000 car loan. Estimate what the total cost of the loan would be for a 60-month loan.

- If you want to know the answer, here's an auto loan calculator.

Here are the ready-to-go slides for this Question of the Day that you can use in your classroom.

Behind the numbers (MarketWatch):

"For those with bad credit, average auto loan rates range from 11.53% to 21.32% on average for new and used vehicles. Subprime or bad credit is typically reflected in a FICO score of 579. If your credit score falls below this threshold, a lender may assume an inability to pay bills on time and can result in higher interest rates or a lack of loan eligibility."

-------------

Go over the basics of credit scores with your students using the NGPF activity INTERACTIVE: FICO Credit Scores!

-------------

Want to extend this activity so students can calculate for themselves the cost of bad credit? Check out this NGPF Activity, Calculate: Impact of Credit Score on Loans

About the Author

Mason Butts

After graduating from UCLA with a Master's in Education, Mason spent 5 years as a science educator in a South Los Angeles public high school. He is committed to supporting the holistic growth of all students and empowering them to live a life of relational, academic, and financial success. Now settled in the Bay Area, Mason enjoys facilitating professional developments and partnering with educators as they prepare students for a bright financial future. When Mason is not building curriculum or planning a training, he can be found cycling, trying new foods, and exploring the outdoors.

SEARCH FOR CONTENT

Subscribe to the blog

Join the more than 11,000 teachers who get the NGPF daily blog delivered to their inbox:

MOST POPULAR POSTS

3